How to Amend a Trust in California

A trust is a powerful estate planning tool that helps individuals and families manage their assets, avoid probate, and ensure a smooth transfer of wealth to beneficiaries. However, the law is constantly evolving and your personal life circumstances may change over time. Eventually, most people who create a trust will either need or want to update it. Whether you want to update beneficiaries, change trustees, or modify distribution terms, it’s important to follow the correct legal process to ensure your amendments are valid. Here’s how to amend a trust in California.

Can a Trust Be Amended?

If you create a revocable living trust, you can amend it at any time during your lifetime, as long as you are mentally competent. An irrevocable trust, on the other hand, is generally more difficult to modify, but in certain situations, changes can be made through court approval or agreement among beneficiaries.

When To Update Your Estate Plan

It’s important to know when to update your estate plan. In general, there are three basic reasons to update your estate plan:

- Changes in your family relations (such as marriage or divorce, the birth of a child, or other significant life events)

- Changes in your economic situation (such as receiving a large inheritance)

- Changes in external factors (like a major change in California estate law or moving to a new state)

Check out our full blog post about when to update your estate plan. Reviewing your estate plan around every five years should help you stay on track.

Ways to Amend a Revocable Trust in California

If you have a revocable trust and need to make changes, here are three common ways to do so:

1. Trust Amendment

A trust amendment is a legal document that modifies specific provisions of your trust while keeping the rest of the document intact. This option is best for minor changes, such as:

- Updating beneficiaries

- Changing successor trustees

- Modifying distribution terms

2. Trust Restatement

A trust restatement replaces the entire original trust document but keeps the original trust name and date. This is useful when multiple changes are needed or when the original trust has become outdated. Benefits of a restatement include:

- Maintaining continuity (no need to transfer assets again)

- Avoiding confusion from multiple amendments

- Keeping the trust structure but updating its terms

3. Revoking and Creating a New Trust

In some cases, it may be best to revoke the original trust and create a new one. This is usually recommended when:

- The changes are substantial and affect the core structure of the trust

- The original trust is outdated and does not comply with current laws

- You want to make a significant shift in how assets are managed and distributed

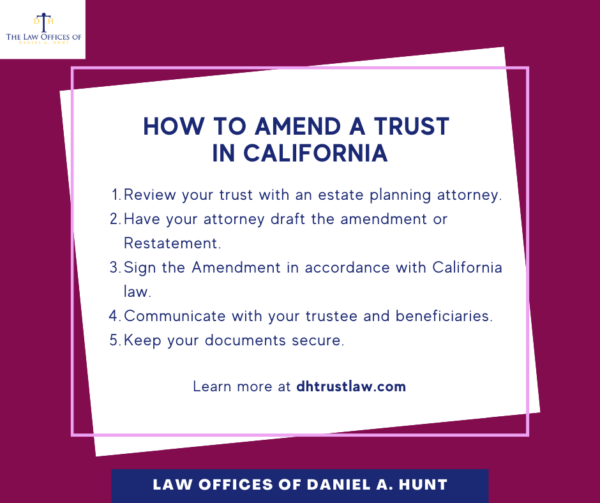

How to Properly Amend a Trust in California

When amending a living trust, follow these steps to ensure your trust amendment is legally valid:

- Review Your Trust Document with an Attorney

Consult with an experienced estate planning attorney. They can share any recent law changes that could affect your estate plan, and help you determine the best way to amend your trust. - Have your Attorney Draft the Amendment or Restatement

Have your attorney prepare a written document outlining the changes. It should clearly reference the original trust and specify the modifications being made. If your trust has provisions that outline specific instructions on how amendments must be made, your attorney should ensure that the amendment complies with these requirements. - Sign the Amendment in Accordance with California Law

California law requires that trust amendments be signed and dated by the settlor(s), typically in the presence of a notary public. - Communicate with Your Trustee and Beneficiaries

If the changes affect your trustee or beneficiaries, it’s a good idea to inform them to avoid confusion later. - Keep Your Documents Secure

Store the amended trust document with your other estate planning records. Your attorney should retain a copy for your estate planning file.

Can You Amend a Trust Without an Attorney?

Some people wonder if they can amend a trust without an attorney. While it may be possible to amend a trust on your own, it’s not recommended. Even small mistakes in wording can lead to unintended consequences, such as disputes among beneficiaries or an invalid amendment. It’s always worth seeking out an experienced estate planning attorney to avoid future potential litigation and ensure that your amendment is properly drafted and legally sound.

If you have any questions about how to amend a trust in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.